Biotech headed into 2022 with abundance. Too many biotechs, too many candidates in development and, apparently, too many employees. Something had to give.

That certainly won't be the case for 2023. After a brutal year in the markets that saw companies slashing programs, culling staff and reorganizing, the industry is much leaner and preparing to find its voice again.

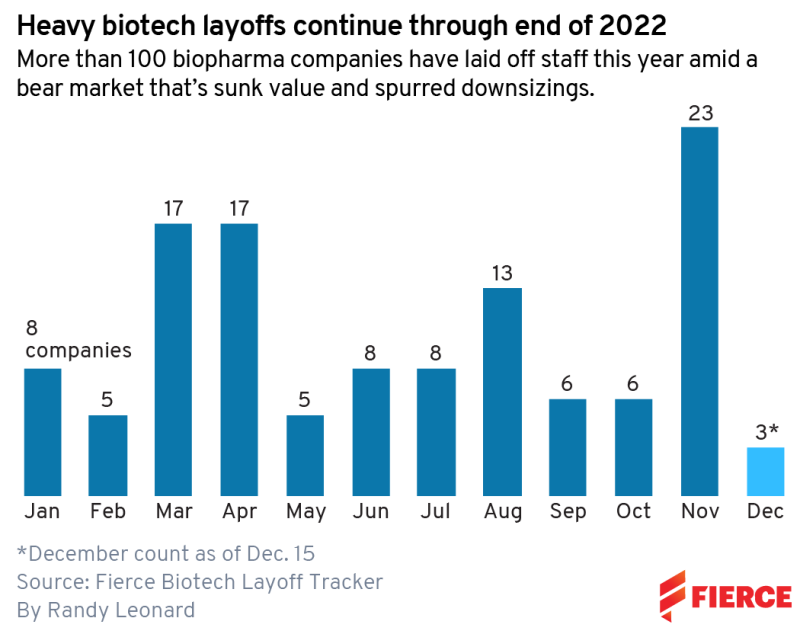

Experts are split on whether the pace of layoffs will slow down in 2023. Twenty-three companies reported layoffs in November, the highest of any other month, according to a Fierce Biotech analysis.

Leslie Loveless, CEO of life sciences executive search firm Slone Partners, thinks the wave will crest, probably after the much-anticipated annual J.P. Morgan Health Care Conference in early January, which will set the tone for the year. Loveless said industry watchers will want to see how bullish investors seem to be on the industry.

“I talk to investors every single day in the life sciences space, and there's varying degrees of optimism,” Loveless said in an interview with Fierce Biotech. “I don’t have … the vibe from any of the investor partners that we work with that they are losing their enthusiasm for the space that we serve.”

Optimism is not ubiquitous, however. Eric Celidonio, founder and managing director of Boston-based recruiting firm Sci.bio, expects layoffs to continue through next year. In March, he correctly predicted much of the layoff trend seen through 2022 on the assumption that smaller biotechs would need to drastically reduce payroll to stay afloat. Buoying the industry as a whole is persistent hiring by larger pharmas, he says.

You can also hear about biotech trends in 2023 in our podcast The Top Line

“It's still a decent market, and it's decent for one reason—it’s that Big Pharma is flush with cash and they're still hiring,” he said. “So they’ve obviously kept this party going.”

One reason for the lackluster investment in smaller biotechs is the intense focus in recent years on platform technology over hard clinical assets that could ultimately make some money, Celidonio says. Platform technology is a means for discovering and validating potential therapeutic targets, whereas forming a company around individual therapeutic assets could offer something to take to regulators a little sooner.

Celidonio added that hesitance to engage with unvalidated technology likely contributed to the smaller-than-expected merger and acquisition market that many thought would scoop up smaller companies with potential. Instead, layoffs and culls persisted, even when valuations were low.

And hear Glenn Hunzinger of PwC talk about his 2023 expectations in a recent episode

One thing contributing to the continued uncertainty is the up-and-down nature of the macro environment, according to Loveless. Companies are choosing to act sooner rather than later when it comes to layoffs to ensure they have the cash runway they need for the new year. This extra cautious approach has certainly been hard on staff, but companies are trying to focus on the most important assets they have while reserving the ability to turn things around and rehire if needed, Loveless said.

From what Loveless has heard, the so-called downturn that biotech is experiencing now is not expected to continue long term. Companies are “giving themselves a little bit of cushion to see what happens in the first half of the year,” with the hope that they can bounce back hopefully with additional investment dollars and rebuild where it makes sense.

But clients Celidonio works with are turning to hiring contractors instead of full-time employees to save additional funds, he says, adding, "that's where the demand is right now.”

Time to ‘right size’

Going back about three years, as COVID-19 hit and innovators scrambled to make tests, therapies and vaccines, the biotech market thrived. The interest spilled over across the industry leading to many things getting funded that shouldn’t have been, according to Poseida Therapeutics CEO Mark Gergen. Gene therapy is the best example, he said, citing an extremely overcrowded space with many companies working on similar technologies.

“It was so frenetic, the pace of what happened in 2021 into the early part of 2022, that there probably is a little bit of right sizing happening too,” Loveless said.

Companies saw the writing on the wall after the first quarter of 2022, and pipeline cuts occurred nearly every day heading into December. Executives had to make tough calls about continuing to keep the lights on or cutting once promising candidates.

At the end of September, Context Therapeutics added its name to the growing list, putting all nonessential activities on hold to extend its cash runway into 2024.

“We stood back and looked at the market,” CEO Martin Lehr told Fierce Biotech at the time. “It doesn’t make sense to build a big independent biotech company right now; what we are is a company with two products that are both doing well.”

A similar story unfolded for ProQR Therapeutics, an RNA therapy company that was shaken up by a critical phase 2/3 failure of then-lead asset sepofarsen. After the February flop, the company was forced to lay off 30% of staff. Founder and CEO Daniel de Boer said 2022 has been an “extremely difficult year” and the trial results were a complete surprise.

“Now, we weren't really prepared for that scenario,” he said. “[W]e were actually building our company to file for registration and subsequently launch the products … around this time,” he said. The company has since pivoted to prioritize a new therapeutic platform partnered with Lilly.

Gergen also had to make some tough calls. Poseida stopped enrollment in a phase 1 trial of solid tumor autologous CAR-T P-PSMA-101 in the belief that its allogeneic platform is the future. The choice wasn’t driven by financial conditions, but rather the high rate of complications associated with autologous therapies, the CEO said.

“We went from the highest of highs—we’re not going to see that kind of excitement again for years,” Gergen predicted. “I think most people’s expectations are that the bear market will continue in 2023.”

‘Crashing into the rocks’

Mizuho believes that for biotech, the “worst days from the recent two-year correction are now likely behind it.” The industry has never seen three consecutive years of negative returns, and Mizuho does not expect 2023 to rewrite history. The analyst firm says this is the second longest and deepest downturn in history, second only to the genomics bubble of 2001.

A silver lining of the rocky climate is more selectivity, and companies with differentiated technologies will prosper, according to Gergen.

“It's a tough market,” he said. “I've been around this industry for 30 years, and this is not the first rough seas we've seen. In the moment, it seems a little more brutal than some of the past periods of turbulence, but it'll correct itself in time. We hope that next year we'll start to see some stabilization.”

Gergen thinks the new year will bring biotech deals, partnerships, mergers and, unfortunately, bankruptcies. Many of these actions will be “driven by desperation,” he said.

“When everything's crashing into the rocks, that’s when you need to be calm,” Gergen advised. “Things will improve and some companies will go away but it’s probably what’s right.”

Mizuho estimates that large cap pharmas have $200 billion of cash on hand, which compares to small and mid-cap biotechs’ aggregate market cap of $500 billion, so 40% of the entire market. Therefore, Big Pharma could help in consolidating the biotech sector.

PwC predicts that strategic realignments and portfolio management will continue into 2023. “Companies will need to adhere to a clear playbook to deliver the desired outcomes. Prepared and proactive management teams willing to consider both acquisitions and divestitures will be best positioned to deliver superior returns,” the consulting firm said in a new report on M&A. Swift decision making will also be key to value creation.

There also may be bolt-on value in assets that other companies have had to relinquish, like ProQR's sepofarsen. Executives are working behind the scenes to find a partner and discussions are progressing but de Boer declined to provide specifics, saying he hopes to have an update next quarter.

Investors will be more interested in companies and assets that have a little less risk, according to Loveless. They will have to weigh FDA approval processes, regulations and the challenges of certain disease areas or indications.

“Sometimes you have to have a moment of reckoning to figure out exactly where you're going to put your dollars and time and make sure that it's in the best interest of the industry,” Loveless said. “We are absolutely seeing investors take their time as it relates to where they are investing.”

No matter what happens in 2023, the path out of this abysmal year is not going to be easy.

“If I had one piece of advice to give, it would be to be kind,” Gergen concluded. “It’s going to be a rough road.”